What Is BRRRR Method Of Investing in Texas?

The BRRRR strategy for real estate investing in Texas is an amazing way to build a portfolio of rental properties and create long-term personal wealth. Our team at Bright Bid Homes are strong advocates of the BRRRR method by Bigger Pockets who provides a great foundation to start the BRRRR property investment journey. However, it is just the starting point. It is the in field experiences from countless deals and rehab projects where the true knowledge is gained and learned. Our goal in this blog post is to share that learning and offer guidance on how to implement the BRRRR real estate investment method in a more dynamic, effective, and profitable way.

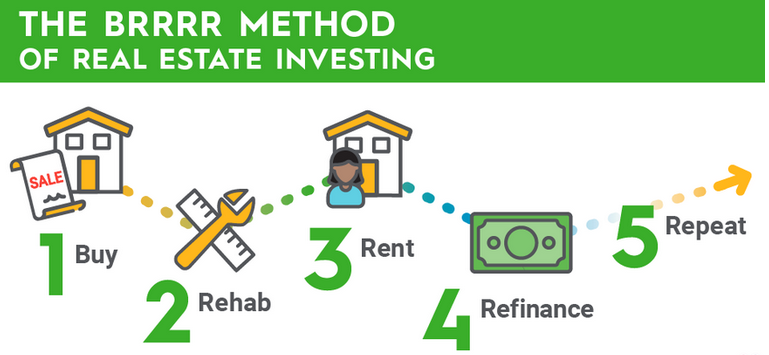

What Does BRRRR Mean?

BRRRR is an acronym for “Buy Rehab Rent Refinance Repeat” that was coined by real estate investing influencer Brandon Turner of Bigger Pockets around 2017. The term and real estate investing strategy gain big prominence for its effectiveness during the low mortgage interest rate era over the past decade. Low mortgage rates and the advent of DSCR rental property loans allowed ample cash flows to fund and scale the investment strategy not only in Texas but throughout the country. An investment rental home portfolio built with this investment strategy is compelling since it generates passive rental income from tenant rent payments and requires significantly lower investment capital.

Key Factor to BRRRR: Finding Distressed Properties in Texas

The core concept is to find distressed properties, usually single family residential homes that can be purchased at a material discount to the after repair value also called ARV. Under this investment strategy, the distressed properties usually need significant renovation and remodel work to realize its ARV and market rent ready standards. It is common that these distressed properties have some combination of leaking roofs, old HVAC systems, foundation issues, non-functional kitchen, and dated cosmetics from the era of the 1980s or 1970s. Therefore, the BRRRR method emphasizes that real estate investors should not pay more than 70% of the after repair value (ARV) of the distressed property. However, once the rehab and renovation are completed, these once distressed properties can be converted to cash flow generating rental homes for years to come.

Step 1: Buy a distressed property for 70% ARV

Forget fancy algorithms, the first hurdle is finding those BRRRR hidden gems – distressed properties priced at 70% or less of their after-repair value (ARV). It’s not just spreadsheets and BRRRR calculators; it’s about hustle and networking. Hit the pavement, talk to homeowners who are considering selling a property. Be sure to think open minded with an eye towards non-standard type opportunities such as condemned houses that current homeowner does not know what to do with. Or maybe you drove by a recently fire damaged property? How about when those big Texas hail storms hit and do roof damage? There could be a house that has some significant water damage and the homeowner is interested in selling the house instead of dealing with the cost and aggravation of repairing it.

After that, connect with hard money lenders who have their ear to the ground. Remember, hard money lenders often deal with motivated sellers of distressed properties looking for a quick exit all the time.

Be sure to leverage technology in your favor. For example, we recommend the Backflip app (its free!) that lets you “drive for dollars” and track and get estimated ARVs for properties that look interesting. Put that pen and notepad away, and leverage technology to increase the number of properties you can find, track and put offers on. And the best part, Backflip will give you a loan to buy the property – all from your smart phone.

Step 2: Rehab the distressed property to bring to market and rent ready standards.

Find a good contractor! Focus on strategic repairs and upgrades that will raise the value and rental income of the property. Not all improvements will get an appropriate ROI. Our experience in this area is unparallel given our depth of coverage in Texas and throughout Dallas Fort Worth, so feel free to reach out if you have more specific rehab and repair questions.

In our years of real estate investment in DFW region, we’ve learned the paramount importance of adhering to Texas Property Code standards, not just for legal compliance but for fostering long-term tenant relationships and ensuring asset longevity. We personally oversee the rehab process, ensuring we choose contractors who not only offer competitive rates but also understand the unique challenges of Texas properties, such as soil-specific foundation issues in DFW as detailed in this Reddit forum on foundations. This hands-on approach and meticulousness in vetting have been instrumental in mitigating risks and maximizing returns on rental property investments. For older homes, be sure to check that the house foundation is stable with a professional engineering inspection and plumbing sewer lines are flowing properly especially if cast iron lines are still in the house. A good BRRRR investment starts (and fails) with a level foundation and flowing plumbing pipes.

Step 3: Rent The Property

Get the cash flow rolling by leasing out the property. Find a reliable rent paying tenant by either hiring a property management company or doing a thorough vetting yourself. For example, check the potential tenant’s history of rentals. Any evictions on their record in Texas? Credit score decent? Have current and stable employment?

Step 4: Refinancing – How To Refinance BRRRR

Once the property BRRRR rehab is completed, has rental income generating tenants, investors should look to refinancing options from mortgage lenders and DSCR loan providers. The value of the home should be materially higher after the home improvements and rehab have been made. This cash out step in the BRRRR process allows you to funnel cash flow into another similar rental property investment.

Step 5: Repeat

This is the fun part of the BRRRR cycle. Use the money and cash flow from refinancing to buy and rehab a new investment property. Yup, the beauty of the whole BRRRR method is that it allows you to do it all over again! Go and find more distressed properties and buy them at no more than 70% of ARV and that will generate the 1% rule for rental income and cash flow. And buy that next BRRRR investment property!

Example of the BRRRR strategy in action

Get your spreadsheet and BRRRR calculator ready, let’s dive into an example of how the strategy works. Let’s say you buy a distressed property in Dallas TX for $200,000 with 20 percent down of $40,000 and rehab costs are $50,000 giving a tally of $90,000 of invested capital so far.

In the rehab, for $50k you are able to do significant value-add repairs and upgrades with a new kitchen with stainless steel appliances, new granite countertops, and white shaker cabinets. You also fully remodel both bathrooms and add new LVP flooring and carpet in bedrooms. Now the remodeled property appraises for $350,000, and you’re able to rent it out for $2,500 a month to cover the expenses on the initial loan and pocket some extra cash. (Your exact market rental price is specific to the local Dallas neighborhood and must account for insurance, property taxes and maintenance)

With some mortgage payments made, maybe now you owe $205,000 on the initial $210,000 hard money or mortgage loan. While you’re earning rental income, you do a cash-out refinance for $245,000 – 70 percent of the new appraised home value. You pay off your first loan of $210,000, leaving you about $35,000 cash in your pocket. You then use that cash to restart the cycle to Buy Rehab Rent Refinance Repeat. Exciting stuff, right?

We also highly recommend another Bigger Pockets icon David Green’s book on the BRRRR method in real estate which he gives many great examples of the BRRRR method in action.

We also found these case studies on the BRRRR method, a success story example, and interesting podcast example as offering great and unique insight.

Is the BRRRR strategy dead in Texas in 2024?

So, what are the challenges for the BRRRR strategy in 2024? What about Texas specifically? Is the BRRRR method dead in Texas? Simply put, interest and mortgage rates have spiked significantly over the past 12 months. The BRRRR method heavily relies on a low interest and mortgage rate environment to foster the virtuous cycle to Buy Rehab Rent Refinance Repeat.

We are constantly following housing market trends and pricing in Texas. In our view and study of the real estate market in the Dallas Fort Worth metroplex, we do not believe that this investment strategy is dead, but the available opportunities are fewer in between. The key to finding a good BRRRR strategy deal to buy is to target what we call physically distressed properties. Now, finding these diamonds in the rough is key. Think properties with fire damage, burst pipes from winter freezes, or outdated layouts. These distressed gems often sell well below the 70% ARV sweet spot mentioned by Bigger Pockets, but be prepared to roll up your sleeves for some serious rehab work.

What Is Difference Between House Flipping vs BRRRR?

Some real estate investors prefer a quick flip, buying low, renovate and repair fast, and sell high. That’s the house flipper game. But with BRRRR, these homebuyers are in it for the long haul. We transform those distressed properties into income-generating machines, building a rental portfolio brick by brick. While the initial timeline might be longer, the passive income stream makes it worth the wait.

There are advantages to both and choosing a BRRRR strategy over a house flipping strategy simply boils down to the timeline for investors. Some property investors do both – house flip and BRRRR to buy and hold. The one major factor working against the BRRRR method in today’s housing market is the current high interest and mortgage rates make the refinancing of investment properties more difficult. This has pushed more distressed property investors to lean towards flipping and away from holding onto houses until mortgage rates come down which is an unknowable timeframe.

Bright Bid Homes Can Help You BRRRR Or House Flip Effectively

As licensed real estate agents and realtors in both Texas and Florida, we have unique experiences and stories to tell. We know the BRRRR method and house flipping strategy well as we have done over 2,500 rehabs that are both house flipper and BRRRR focused in Texas with the vast majority of our work focused on distressed properties and helping real estate investors make a deal on a spreadsheet with a flip or BRRRR calculator a reality.

For both fix and flip investors to BRRRR adherents looking to buy and hold a long-term rental property in Texas, we know how to navigate the Texas and DFW housing market to achieve your investing vision. Its all about creating a housing product that will maximize your investment dollar.

We know how and focus our company’s mission to help you achieve that goal.

BRRRR Method In Texas

From Fort Worth to Dallas TX, we specialize in making the 70% ARV rule work as we are able to walk any distressed properties for sale with together with you and if you give us an hour or two onsite to inspect the house, we can give you a tight range of rehab cost estimates that can be plugged into your spreadsheet and BRRRR calculator to tell you if the 1% rule can be met or if your minimum cash flow and rental income targets are achievable.

We believe that these cities in DFW are the best target markets for BRRRR method investing: Arlington, Grand Prairie, Desoto, Cedar Hill, Irving, Plano, Richardson, Lewisville, Duncanville, and of course Dallas and Fort Worth.

We view all investment methods as a partnership as we are not simply looking to rehab one house together, we want to rehab many potential rental properties together to help you build a portfolio of passive income generating investment homes.

Despite market shifts, the BRRRR method’s core principles – strategic acquisition, smart renovation, and effective refinancing – remain valuable building blocks for long-term investment success. However, navigating the nuances of the current market requires specialized expertise. At Bright Bid Homes, we’re not just BRRRR enthusiasts; we’re local market strategy practitioner with a proven track record of helping investors unlock the full potential of distressed properties. Our combination of deep market knowledge, strategic partnerships, and hands-on experience sets us apart. Let us put our expertise to work for you – contact us today and discover the Bright Bid Homes difference.