Dallas Housing Market Trends: Prices, Home Values, Forecast [Updated Sept 2025]

*updated 9-16-25

Slower Sales, Rising Inventory, and an Uneven Path Forward

The Dallas housing market is continuing a gradual shift, and the latest numbers reveal a murky picture of mixed market signals.

There’s more inventory.

Homes are sitting longer.

Prices are still inching upward, but not dramatically.

For buyers, this means more leverage and negotiating power. For sellers, it’s a wake-up call to price smart and prep right.

And for investors, it’s a season to double-check the math before writing the offer.

Here’s what stands out in this month’s update, backed by fresh MLS data and clear year-over-year comparisons.

Whether you’re a homebuyer, real estate investor, thinking about selling your Dallas house, this updated report is packed with data and trends you won’t want to miss if you are keeping an eye on the DFW housing market, .

Let’s break down the latest numbers, compare how Dallas stacks up against other cities like San Antonio and Collin County home sellers, and explore what may be ahead for the Dallas/Fort Worth Metroplex.

Dallas Real Estate Market Stats

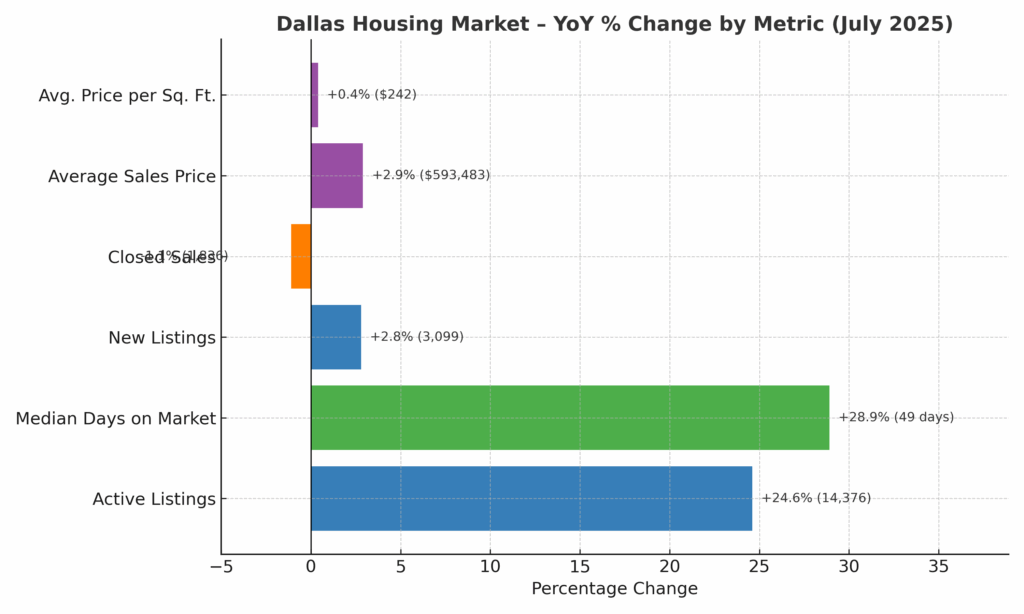

| Metric | July 2025 (*latest updated data) | Year-Over-Year Change % |

|---|---|---|

| New Listings | 3,099 | + 2.8% |

| Active Listings | 14,376 | + 24.6% |

| Closed Sales | 1,836 | – 4.8% |

| Average Days on Market | 28.9 days | + 28.9% |

| Average Sales Price | $593,483 | + 2.9% |

| Average Price per Square Foot | $242 | – 1.7% |

📦 Inventory Keeps Growing

Dallas is seeing a steady build-up in active listings, which are up 24.6 percent compared to last July.

New listings are slightly higher too, but it’s the unsold inventory that really stands out.

Homes are stacking up.

Buyers are shopping slower.

Some are waiting for better deals. Others are cautious due to rates.

If you’re selling, it’s no longer enough to just list your home and wait. To stand out, you’ll need proper pricing, strong photos, and a home that feels updated and move-in ready.

Dallas Market: Homes Are Taking Longer to Sell ⏳

The average home in Dallas now spends 49 days on the market.

That’s another big increase of 29 percent from last year.

This doesn’t mean demand has vanished, but it does mean buyers are taking their time. Some are waiting for price drops. Others are comparing more homes before making a decision.

One leading indicator to watch closely is interest rates. As rates shift up or down, buyer demand often follows. When rates dip, demand tends to rise quickly. When they climb, buyers may pause or adjust their budgets.

For sellers, this is a signal to be patient.

The days of weekend bidding wars are behind us for now. A well-prepared home will still sell. But it may take a few extra weeks.

Average Home Prices in Dallas: 💲 Prices Continue to Rise… Very Slowly

Even with inventory rising, the average sales price in Dallas climbed to $593,483.

That’s a 2.9 percent gain year over year. The average price per square foot ticked up just 0.4 percent, now at $242.

This kind of modest growth suggests the market is still competitive. Buyers aren’t overpaying like they were two years ago. But prices are holding steady.

In many ways, this is a healthier long-term trend.

| City | Average Home Price |

|---|---|

| Dallas TX (Dallas County) | $593,483 |

| Collin County Texas | $622,000 (est.) |

| San Antonio | $328,000 (est.) |

| El Paso | $260,000 (est.) |

| Austin | $598,000 (est.) |

| San Diego | $845,000 |

| Las Vegas | $449,000 |

Dallas continues to offer strong value relative to major metros across the United States, especially when factoring in cost of living, commute times, and access to top-rated school districts like those in Highland Park or Plano TX.

Housing Inventory:📉 Fewer Homes Are Closing

Closed sales dropped 1.1 percent from last year.

That might not sound like much, but it’s a sign that some deals are falling through. Or buyers are simply pausing.

This doesn’t mean the market is crashing.

It just means the frenzy has cooled. For flippers or short-term investors, this could be a window to negotiate better deals or structure creative sales like a selling with owner financing.

But make sure the resale math still works.

🧠 What You Should Do Now in Dallas Real Estate

Whether you’re buying, selling, or investing in the Dallas housing market, strategy matters more than ever.

The days of rapid-fire transactions are just memories.

Success now comes from preparation, precision, and knowing what today’s market is actually doing — not what it used to do.

Here’s how to approach it based on your market role:

- Buyers

There’s more inventory to explore, but smart buyers still move quickly on the right property.- Get fully pre-approved, not just prequalified, so you can compete with confidence.

- Use the extra days on market to negotiate seller credits, rate buydowns, or home warranties.

- Look for stale listings — properties that have sat 90+ days may present opportunity.

- Track interest rates weekly. Even small changes can impact what you can afford or how quickly others jump in.

- Sellers

You can still sell for top dollar, but buyers are more cautious and selective than they were in recent years.- Price strategically based on comparable homes that have sold within the last 90 days.

- Focus on broad appeal. Clean, neutral spaces with updated lighting and fixtures make a strong first impression.

- Stage it if possible — especially if the home is vacant or unique in layout.

- Be responsive and flexible on showings. A slower market means buyers will shop around.

- Investors

This market rewards patience and detailed analysis. Quick flips may be harder to pull off, but value-add plays still exist.- Zero in on listings with extended days on market, seller concessions, or signs of deferred maintenance.

- Run realistic exit comps. Price appreciation is slowing, so plan conservatively.

- Analyze rental demand by zip code to avoid vacancies if holding long-term.

- Explore creative financing or subject-to deals where sellers are equity-rich but time-constrained.

Jobs, Economy & Real Estate Demand in Dallas

A major reason Dallas home values have stayed resilient is its strong economic base.

Major employers like Texas Instruments, Southwest Airlines, and the continued growth in tech and healthcare sectors have kept the unemployment rate low and job growth steady.

This economic momentum is key for the Texas housing market forecast. As long as jobs stay abundant, demand for new homes and real estate investment opportunities will likely remain strong—especially in areas like University Park, Lake Highlands, and along the Dallas North Tollway corridor.

Dallas Housing Market Forecast 2025 into 2026

Dallas isn’t crashing. It’s not booming either. The market is adjusting. In many ways, that’s a good thing.

Here’s what we expect heading into 2026:

- Inventory will stay elevated.

- Buyer activity may increase a bit due to lowering interest rate expectations and school-year timing.

- Prices will likely continue rising, but at a sluggish and slow pace.

Suburban pockets with great schools, new construction, or limited inventory may outperform. But broadly, Dallas is in a season of balance.

What Are Dallas Housing Statistics and Data Telling Us?

The Dallas housing market is shifting—slowly but steadily.

While sellers still hold pricing power in some neighborhoods, rising housing supply, stretched affordability, and longer average days on market are giving buyers room to breathe.

For buyers and sellers alike, staying informed is key with Dallas housing data and statistics telling the story.

We’ll continue to provide this kind of high-trust, data-driven content with every material move in the DFW metroplex and North Texas real estate market.

Cite this post:

Bright Bid Homes | https://www.brightbidhomes.com/dallas-housing-market-trends-prices-home-values-forecast/

📞 Contact us for local insights and zip code–level data.

** Disclaimer: This Dallas market overview is for informational purposes only and reflects publicly available housing data as of the most recent reporting month. All figures—including median sales price, property prices, Dallas home prices, and the current median home price—are estimates derived from MLS data and other sources like Zillow and Redfin. Comparisons to the previous year, past year, and recent years are included to provide historical context. Market conditions can change rapidly, and key factors such as inventory levels, the number of housing units, and median listing price may vary by zip code and segment. Always consult a licensed real estate agent for guidance specific to your situation.

*** About the Authors: Hilary Schultz is a licensed Realtor in Texas and an experienced real estate investor with deep expertise in the Dallas–Fort Worth housing market. As a trusted community voice and executive board member of her local Texas PTA, Hilary brings both professional insight and a personal commitment to serving DFW homeowners.

Together with her husband Patrick Schultz, the duo brings over 40 years of combined experience and has successfully completed more than 2,800 real estate transactions across the state. Their work reflects a dedication to helping homeowners make informed decisions with confidence and clarity.

Whether you’re exploring your options or ready to sell, their mission is simple: deliver expert advice, honest solutions, and a stress-free home selling experience. Read our online reviews to see how we’ve helped Texans just like you.