*updated 5-29-2025

In 2025, selling a home during divorce in Texas remains a common challenge, especially in high-demand areas like Dallas-Fort Worth. For DFW homeowners involved in divorce proceedings, understanding how the home sale fits into the broader divorce settlement is essential. This guide covers legal, financial, and real estate considerations specific to the Texas market.

Selling A Home During Divorce In Texas

Divorce is hard enough.

Figuring out selling a home in divorce?

That’s a whole other layer.

That’s why selling a house in divorce calls for more than guesswork. You need a plan. You need clarity.

And most of all, you need real answers that make sense for Texas laws and the DFW housing market.

For many Dallas-area couples going through a split, deciding what to do with the house isn’t just about money.

It’s emotional.

The family home holds years of memories, but it can quickly become a financial weight when mortgage payments, legal fees, or child custody agreements start stacking up.

Whether you’re in Dallas, Fort Worth, or Arlington TX, this guide breaks down how to handle the legal steps, financial choices, and emotional decisions that come with selling a house after divorce agreement in Texas.

It’s about protecting your interests and finding the best path forward.

Understanding the Sale of a Marital Home in Texas

Why Selling the Family Home Might Be the Best Option

Selling the family home during a divorce isn’t just about money.

It’s about turning the page.

For many couples across Dallas, Fort Worth, and the wider DFW area, holding on to the marital home often brings more stress than comfort.

Sure, the house carries emotional weight. But once divorce proceedings begin, that emotional connection has to be balanced with mortgage payments, property maintenance, and the legal side of dividing assets.

Selling the home offers a clean break.

It gives both parties a chance to access their share of the home’s equity and use it toward what comes next… whether that means paying off joint debts, securing new housing, or setting aside funds for future plans.

For most, trying to co-own the house after divorce just adds friction.

In some cases, one spouse simply can’t afford to keep the house on a single income. The math doesn’t work. Rather than risk falling behind on payments or selling in foreclosure, selling becomes a more practical option.

If children are involved, emotions can get even more tangled.

But stability doesn’t always mean keeping the house.

Sometimes, selling the Texas property lets both parents find homes that better match custody arrangements and financial realities and creating a more manageable living situation for everyone.

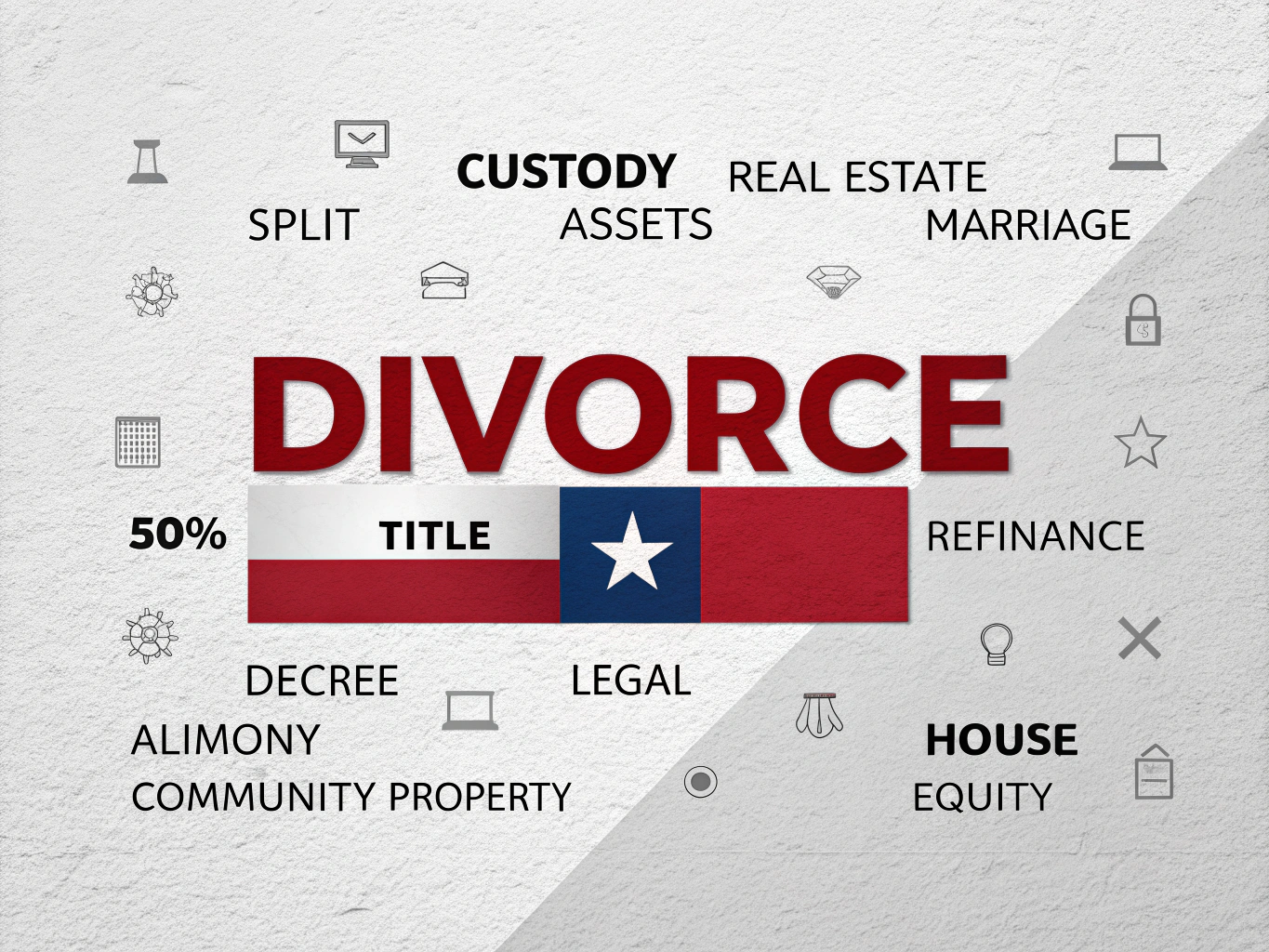

Community Property vs. Equitable Distribution: How It Works in Texas

When it comes to division of assets in divorce, the rules change based on where you live.

Texas is a community property state.

That means anything acquired as a married couple (including the home) is typically considered joint property. Even if only one spouse’s name is on the mortgage or deed, both usually have an equal claim to it.

Compare that to equitable distribution states, where the goal is fairness, not necessarily a 50-50 split.

In those places, judges may factor in income, contributions to the household, or even future earning potential when dividing assets.

In Texas, that equal split simplifies things.

If the house is considered marital property, the equity and sale proceeds are usually shared evenly between both spouses.

But not every situation is cut and dry.

If the home was owned before the marriage, received as a gift, or inherited, it might be considered separate property, which changes the equation.

That’s where working with a qualified divorce lawyer or real estate attorney becomes important. They’ll help determine what’s marital, what’s separate, and division of proceeds in line with the divorce decree and Texas law.

And if you and your spouse can’t come to a mutual agreement on the best way for a sale of the home, a court order may be required to finalize it.

Key Factors to Consider When Selling a Texas Home In Divorce

Legal, Financial, and Emotional Aspects

Selling a Texas property while in divorce proceedings isn’t just about finding a buyer and setting a price.

It involves aligning legal requirements, financial decisions, and personal readiness… especially when the property is in Dallas, Fort Worth, or anywhere across the DFW region.

Start with the legal side.

A divorce attorney or real estate attorney plays a key role in the process. They can review your settlement agreement, help determine whether the home is considered marital or separate property, and make sure each spouse’s interest is clearly protected.

If there’s a disagreement over home equity or how to divide the proceeds, legal guidance can prevent bigger issues later.

Financially, there’s more to think about than just the sale price.

Attorney fees, mortgage balances, and tax implications all need to be reviewed.

If you’re selling your primary residence, you may qualify for a capital gains tax exclusion, which could reduce your tax burden.

But if the property has been used as a rental or has significantly appreciated, a tax professional can help explain any liabilities or available tax breaks before closing.

Then comes the personal side of the sale.

For many divorcing couples, the family home holds years of shared experiences and sentimental value.

Letting it go can feel like losing part of your identity or closing a chapter you didn’t expect to end.

That feeling is real.

Still, when the goal is to divide assets fairly and build something new, sometimes stepping away from the past is the healthiest move forward.

If children are involved, things can get more complicated.

Child custody and child support agreements may affect the timeline and logistics of the sale.

You might need to plan around school transitions, court orders, or family routines.

The goal is to create a living arrangement that balances financial stability with your family’s needs.

Preparing to Sell: Getting the House Ready and Understanding the DFW Housing Market

Once you and your spouse agree to sell, it’s time to shift gears and treat the house like a product.

That starts with understanding the local housing market trends in DFW. Whether you’re in Dallas, Fort Worth, Plano, or Arlington, each part of the DFW area has its own pricing trends and buyer behavior.

An experienced real estate agent who knows the Texas market and has experience with divorce-related sales can help you pinpoint the fair market value of the house based on current conditions.

From there, it’s about presentation.

A few smart updates can go a long way. Fresh paint, clean landscaping, or replacing worn fixtures might make the difference between a sluggish listing and a fast offer.

If you’re dealing with limited funds or tension between co-owners, keep it simple. Focus on home improvements that bring the most impact for the lowest cost.

If your financial situation is tight, it’s worth running the numbers with your agent. Not every fix-up is worth the investment.

The goal is to show the home in its best light without draining what’s left of your budget.

And if you’re looking to avoid the listing process altogether, there are potential buyers in the DFW area, including Bright Bid Homes, that specialize in purchasing houses during divorce.

Sometimes a direct cash offer makes more sense, especially if you’re under pressure to sell quickly or want to skip the hassle of showings, repairs, or buyer financing delays.

More importantly, find a real estate professional who understands how to manage a home sale tied to a divorce agreement.

The divorce process involves more than just marketing and paperwork.

Your agent or buyer should be able to coordinate with attorneys, clarify ownership and proceeds, and help both parties stay informed throughout the home sale.

The right team can make the process more manageable.

It won’t erase the stress entirely, but it will give you structure, options, and a path forward, whether you decide to list your house traditionally or consider a faster, simpler sale off-market.

Steps to Sell Your Home During Divorce in Texas

Where to Start When It’s Time to Move On

The first step in selling a home during divorce is reaching a mutual agreement, either between both spouses or, if needed, through a court order.

If you’re able to work together on the decision to sell, you’ll save time, money, and a lot of legal back-and-forth.

If not, the court may need to step in and make that decision for you.

You’ll also need to decide whether the house will be sold on the open local market or if one spouse plans to keep it.

If one person wants to stay in the home, a quitclaim deed might be required to transfer the other person’s interest. That’s something a divorce attorney or real estate attorney should handle to make sure ownership is properly recorded.

Once you’re both aligned on selling, setting the right asking price comes next.

In the Dallas-Fort Worth market, pricing strategy matters to sell during slower periods of time.

You’ll need to factor in home equity, real estate market trends, and the remaining mortgage balance. A local agent can help you set a fair market value that brings in offers while protecting your financial interests.

If working with an agent feels too slow or complicated, companies that buy houses like Bright Bid Homes offer another path.

We work with divorcing couples across DFW who need to sell quickly, with fewer delays and more clarity around the timeline and terms.

A direct cash offer may not fit every situation, but in the right case, it can reduce stress and keep the process moving.

Before you list or accept any offer, make sure the paperwork is in order.

That means confirming who’s listed on the title, reviewing the mortgage terms, and checking that your divorce agreement outlines how proceeds will be split.

Legal professionals should be involved early to avoid hiccups during closing.

With the right prep, you can move through the home-selling process with fewer surprises and start focusing on what comes next.

Attracting Potentials Buyers and Closing the Sale During Divorce in Texas

First impressions matter.

If you’re trying to attract serious buyers in the middle of a divorce, the condition of the home will absolutely influence how quickly it moves.

You don’t need to take on a major remodel, especially if funds are tight.

But small, targeted improvements like fresh paint, minor repairs, or updated lighting can increase your home’s appeal without draining your budget.

In markets like Dallas, Fort Worth, and surrounding areas, legit buyers notice when a home is clean, neutral, and ready to go.

Even simple curb appeal updates can make a property stand out. The goal isn’t perfection. It’s making sure your home presents well enough to support a solid sale price.

That said, not every situation allows for open houses, weeks of showings, or waiting for a buyer’s financing to come through.

For some divorcing couples, time is a bigger factor than price. In those cases, a direct cash offer from a local company like Bright Bid Homes can be a smart move.

There are no listing delays, no buyer contingencies, and no drawn-out closings.

Of course, it’s important to understand the tradeoffs.

A cash sale might come in lower than what you’d get from a traditional buyer, but the speed and simplicity can outweigh the difference… especially if there’s pressure to finalize the divorce or pay off shared debts quickly.

Once the offer is accepted and closing is in motion, the next step is dividing the proceeds.

This part should follow your divorce agreement or court order.

In Texas, a community property state, that often means a 50-50 split unless stated otherwise.

If you’re dealing with separate property claims or special arrangements, a divorce attorney and financial advisor can help sort out the details.

When handled correctly, the sale of your home becomes a way to close one chapter and fund the next.

Whether you’re home buying again, renting, or simply getting a financial reset, that fresh start becomes possible when the divorce process is clear and the plan is in place.

Common Challenges Divorcing Couples Face in Texas

When One Spouse Wants to Keep the House and the Emotions Run High

One of the biggest roadblocks divorcing couples face is when one spouse keeps the house while the other is ready to sell.

Maybe they want to stay close to the kids’ school, or maybe it’s about comfort and familiarity.

Either way, this situation creates tension that’s both personal and financial.

To keep the house, the spouse who stays usually needs to buy out the other’s share of the equity.

That might mean refinancing the mortgage or offering a lump sum payment.

In Texas, where property values in areas like Dallas and Fort Worth continue to rise, that buyout can be substantial.

If refinancing isn’t an option, whether due to income, debt, or credit, keeping the home might not be realistic.

On top of that, the spouse staying in the house has to be able to afford it alone.

That means managing mortgage payments, property taxes, homeowners insurance, and repairs, all on a single income.

It’s a major commitment that can stretch even a strong financial situation thin.

This is where a divorce attorney or financial advisor can be incredibly helpful.

They can break down the numbers, explain the legal implications, and help determine whether keeping the home is even possible.

Or if selling it would actually lead to a better outcome for both sides.

Some couples consider renting the property out instead of selling it.

While this can sound like a compromise, it often comes with long-term complications.

Co-owning a rental property after divorce means managing income, splitting expenses, and making joint decisions — all while trying to move on.

If the divorce proceedings were already tense, continuing to share ownership rarely helps.

Beyond the logistics, there’s also the personal side of letting go.

For many couples, the family home holds years of shared memories. Walking away from that can feel like another layer of loss. But sometimes, the clean break that comes with selling the house is exactly what both people need to start fresh.

That logistical shift becomes even more difficult when kids are involved.

Parents want stability, routine, and comfort for their children, and selling the home can feel like a disruption.

But with the right plan in place, both parents can move into new spaces that are financially sustainable and emotionally healthier for everyone.

The financial side can also feel too much, especially when you’re juggling attorney fees, an outstanding mortgage, or questions about how the proceeds will be divided.

The main thing is this: whatever path you choose, get the right help early.

Legal professionals and financial advisors can make sure your decisions are smart and fair.

And if selling is the best option, you don’t have to go through it alone.

Life After the Divorce Sale of Your Home

Dividing Proceeds and Planning for What Comes Next

Once the house is sold, the focus shifts to what comes next. For many divorcing couples, that means figuring out how to divide the proceeds and create a more stable future.

In Texas, sale proceeds are usually split according to your divorce agreement or court order. Since Texas is a community property state, that often means a 50-50 division.

Still, every case is unique.

If one spouse has a claim to separate property or if there were special terms included in the settlement, the numbers may look different.

Either way, this step is just as important as the sale itself.

What you do with your share of the proceeds depends on your financial situation.

Some people use the funds to buy a new home in Dallas, Fort Worth, or nearby cities across the DFW area. Others may choose to rent while they reassess and regroup.

It’s also smart to plan for near-term needs. You may need to settle debts, pay attorney fees, or cover child support. If kids are involved, your next living arrangement should work with any custody agreements to keep life stable for everyone.

This is a good time to speak with a financial advisor. Whether you’re setting aside emergency funds, planning for retirement, or facing tax decisions tied to the home sale, a clear financial plan can bring peace of mind. Short-term clarity can lay the groundwork for long-term progress.

Making Clear, Confident Decisions After the Sale

After the home sells, the dust settles.

But there are still big decisions ahead.

One of the biggest is whether to rent or buy.

That depends on your goals, finances, and the local housing market in your area of Texas.

Prices and timing can vary a lot between places like Arlington, Plano, and Denton TX.

Talk to a tax professional as well. The IRS offers certain tax exclusions for the sale of a primary residence, but there are requirements.

How long you lived there and how you filed taxes can affect whether you qualify. Getting legal advice now can help you avoid surprises later.

Finally, take care of yourself too.

Selling the marital home can stir up a lot.

It often marks the end of one chapter and the start of something new. Whether you feel relief or loss, those emotions are real.

You don’t have to go through it alone.

Lean on family, friends, or professionals who understand what you’re facing.

How to Sell a Home In Divorce With Confidence

Selling a home during divorce is never easy.

It doesn’t have to leave you feeling stuck.

With the right guidance, you can move through the divorce process with clarity and control, and come out the other side in a stronger place.

When you work with professionals who understand both Texas real estate and divorce-related property sales, you’re not just checking legal boxes.

You’re protecting your financial goals, making sure your home sale fits your settlement agreement, and giving yourself room to focus on the future instead of getting buried in the details.

Knowing how property taxes, title issues, and current real estate market conditions affect your next move can help you make clear, informed decisions.

It’s not about getting everything perfect.

It’s about making progress in the right direction.

Bright Bid Homes works with sellers in DFW who are going through divorce and need support, clarity, or a faster solution.

Whether you list your home traditionally or accept a direct offer, the important thing is to choose what’s right for your next chapter.

Because selling the home isn’t just a financial step.

It’s a chance to reset.

With the right support, you can turn a difficult moment into a clean break, a fair outcome, and a path that finally feels like yours.

Disclaimer: This article is intended for general informational purposes only and should not be interpreted as legal, financial, or tax advice. Every real estate transaction—especially during divorce—comes with unique legal and financial considerations that vary based on the specific circumstances, including asset division, emotional ties to the home, and the share of the property each party holds.

Whether you’re a sole owner, co-owner, or navigating the sale of a home with a family member, it’s important to understand your rights and responsibilities under Texas law. In some cases, a forced sale may be necessary, while in others, selling voluntarily may be a good idea in your best interest. There are different ways to handle the sale depending on how much money is owed on the property, existing mortgage terms, and whether prospective buyers are involved.

If you’re asking, “Should I Sell My House during a divorce?” or weighing options with emotional and financial weight, speak with professionals who have years of experience in Texas real property matters. A qualified divorce attorney or real estate expert can help determine whether selling is a viable option based on legal obligations and financial planning goals.

For personalized advice, always consult a licensed attorney or tax advisor. You may also want to speak with a real estate professional who can walk you through the process and, if needed, connect you by phone number to local resources or buyer services tailored to your needs.

About the Authors: Hilary Schultz is a licensed Realtor in Texas recognized as a Zillow Top Agent credentials for her service and professionalism. With over 2,800 real estate transactions completed, Hilary and her husband Patrick lead Bright Bid Homes, a trusted resource for Texas sellers dealing with legal or financial transitions like divorce. The family-run business has earned consistent praise from homeowners—see their verified ratings online. Hilary also serves on her local Texas PTA’s executive board and continues to advocate for ethical solutions across the DFW housing market. You can verify her license on TREC or learn more about Bright Bid Homes through their company profile.