*Updated 6-23-25

Explains how to get your house back after foreclosure in Dallas Fort Worth by analyzing Texas foreclosure laws, the right of redemption, and legal recovery options. Covers timelines, notice of default, loan modifications, and property auctions. Designed for motivated homeowners, this 2025 legal-financial guide includes solutions, protections, and alternatives supported by statutory procedures and federal regulations.

How to Get Your House Back After Foreclosure in Dallas Fort Worth

Wondering how to get your house back after foreclosure in Dallas Fort Worth?

You’re not alone and you’re not out of options.

Foreclosure can feel like the end of the road.

But in Texas, there are still legal and financial paths that could help you take back what you lost—or at least recover faster than you might think.

Whether you’re a former homeowner trying to reclaim your property or someone still in the early stages of foreclosure proceedings, understanding the foreclosure process, your legal rights, and your recovery options is the best way to move forward with confidence.

This guide explains what happens after foreclosure and how Texas law works.

Learn what steps you can take—depending on where you are in the timeline. We’ll also break down the right of redemption, repayment plans, court proceedings, deficiency judgments, and more.

Let’s start with what triggers foreclosure in the first place.

If you’ve fallen behind on mortgage payments, received a notice of default, or watched your house go to the highest bidder, you might still have a shot.

Options like repayment plans, loan modifications, or your right of redemption could give you a path back but timing is everything.

This guide breaks down the full foreclosure process in Texas, shows you how to take action fast, and explains the steps that could lead you back to ownership.

Because while foreclosure might have closed one door, it doesn’t mean you can’t open another.

Breaking Down the Foreclosure Process in Texas

In Texas, the foreclosure process moves fast.

Most foreclosures here are nonjudicial, meaning they don’t require a court order.

If you’ve missed mortgage payments, your mortgage company can initiate foreclosure by sending you a series of notices. These typically include a notice of default and a notice of sale, all authorized by the power of sale clause built into your deed of trust.

The deed of trust is a legal document tied to your mortgage loan. When you fall behind on monthly payments, the lender invokes that clause and begins the legal process to reclaim and sell the property.

After the required written notices, the home is listed for a public auction, often held on the first Tuesday of each month.

At the foreclosure auction, the house is sold to the highest bidder. This person or entity becomes the new owner, and you (the former homeowner) must vacate the residential property.

Once that auction happens, reclaiming your house becomes more complicated, but not impossible.

Key Events in the Texas Foreclosure Timeline

Understanding the foreclosure timeline is crucial.

These are the key points that determine whether you can stay in your home, reclaim it later, or at least reduce long-term damage to your finances.

- Missed Payments

Everything starts when a borrower falls behind on mortgage payments. The lender may reach out by phone, email address, or even text message. - Foreclosure Notices

After enough time passes, you’ll receive a notice of default, followed by a notice of sale. Both are required under Texas foreclosure laws. - Auction Scheduled

On the scheduled date (usually the first Tuesday of the month), your foreclosed property is auctioned off. The buyer may be a real estate investor, home buyer, or even your mortgage lender. - Ownership Transfers

Once sold, the property address is legally transferred to the new owner. You’ll be required to leave unless a redemption right applies. - Deficiency Judgment

If the sale price of the home doesn’t cover your full debt, you could still owe the remaining balance through a deficiency judgment.

Every step above offers a chance to act. But timing is everything.

Your Legal Rights Under Texas And Federal Laws

Even in a nonjudicial foreclosure, property owners in Texas have legal rights.

Lenders must follow specific steps, including sending a written notice and allowing time to respond before initiating a trustee sale.

Here’s what you’re entitled to:

- Time to cure missed payments before the sale

- Access to repayment plans or a payment plan

- The ability to apply for a loan modification

- Legal protection through federal laws (especially the CFPB’s loss mitigation rules)

- In some cases, the right to file Chapter 13 bankruptcy to pause or stop foreclosure

If you think your rights were violated—or you didn’t receive proper notice—consulting a foreclosure lawyer or foreclosure attorney may be your best option

The Redemption Period and Right of Redemption

Depending on how your foreclosure happened, you may still have a right of redemption.

This means you can reclaim your home by paying back the sale price, plus any allowable fees, within a fixed redemption period.

In Texas, redemption rights are limited and usually apply only to tax sales, not standard mortgage foreclosures. In a tax sale, you might have up to two years to buy the property back.

But it’s not easy.

You’ll likely need help from a real estate investor, legal team, or financial partner to make the numbers work. You may also be asked to cover interest, legal costs, or other loan terms.

If this option is on the table, don’t wait. A foreclosure attorney can help you calculate the full cost and timeline.

Nonjudicial Foreclosures vs. Judicial Foreclosure Proceedings

Most Texas foreclosures are nonjudicial foreclosures and happen outside of the court.

But there are exceptions. The biggest difference between the two is time.

In a judicial foreclosure, the lender must go through court to get a court order before selling the home.

This takes longer and may provide more time to respond or raise objections. Judicial cases often involve:

- Disputes over legal rights or title

- Complex ownership issues

- Junior liens or unresolved debts

- Missing or unenforceable Promissory Notes

Nonjudicial foreclosure, by contrast, uses the power of sale clause in the deed of trust and bypasses the court system entirely. It’s quicker and less expensive for lenders.

If you’re unsure which type you’re facing, check your mortgage loan documents or ask a foreclosure lawyer.

How Federal Laws Protect Property Owners

Alongside state law, federal laws play a powerful role in protecting homeowners across the United States.

Under the rules enforced by the Consumer Financial Protection Bureau (CFPB), lenders must:

- Offer loss mitigation options before foreclosure begins

- Send all required written notices

- Give homeowners time to apply for help

- Avoid foreclosure during active review of a repayment plan or loan modification

- Act in good faith throughout the foreclosure proceedings

If your mortgage company ignored any of these requirements, you may be able to pause or reverse the sale.

That’s why early action is always the best way forward.

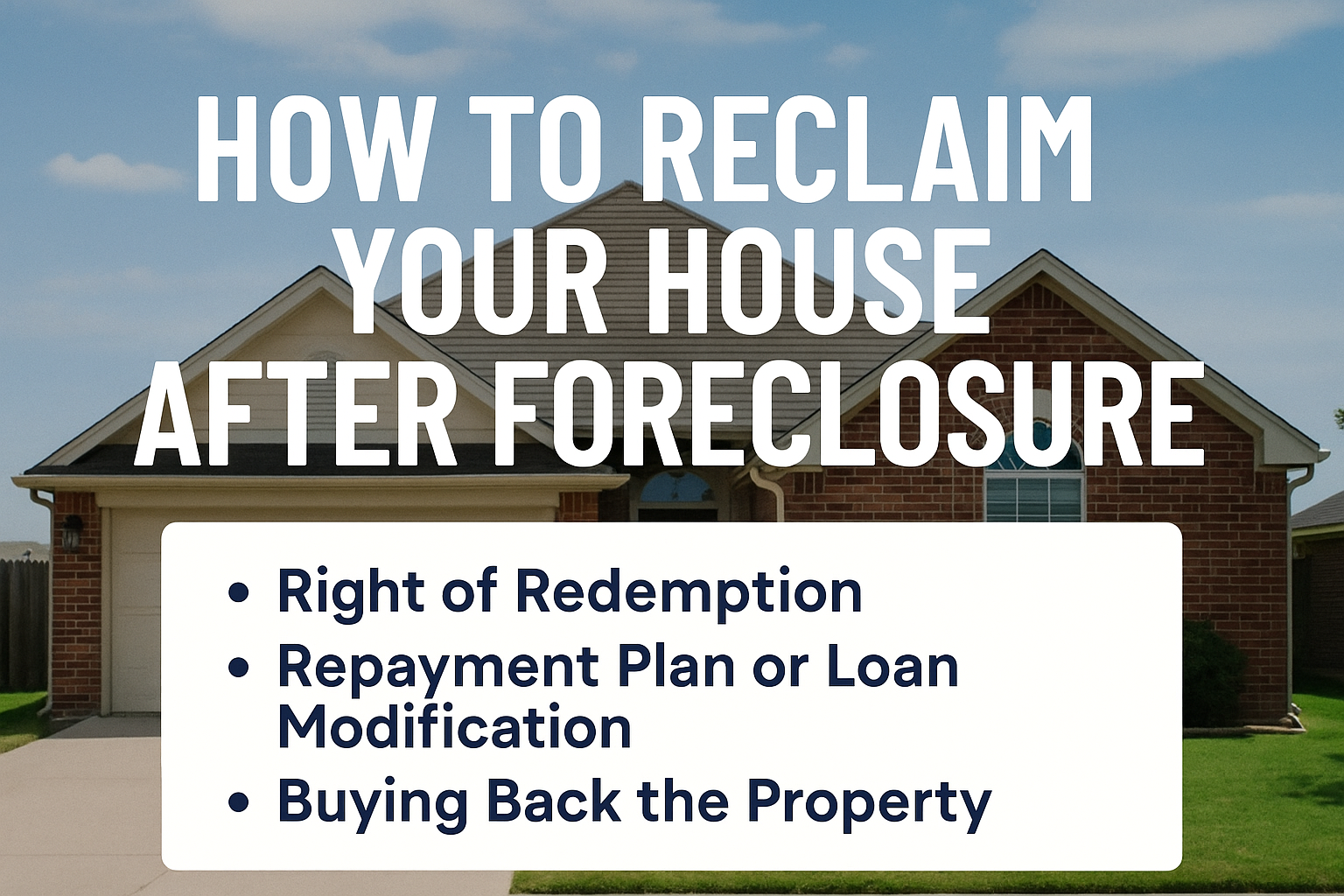

How to Reclaim Your House After Foreclosure

After your home is sold at auction, your options are more limited.

But not zero.

Some former homeowners negotiate directly with the new owner or real estate investor who purchased the property.

In certain cases, they may agree to sell it back to you at fair market value or the original sale price. Other owners may pursue redemption if the foreclosure was a tax sale, though this is time-sensitive.

There are also families who focus on rebuilding.

They work to improve their credit score, save for a down payment, and start over with a new home in the same ZIP Code or nearby.

Reclaiming your home is possible, but it’s not always the best option.

Think through the numbers, timelines, and your long-term financial situation before making a move.

Exploring Repayment Plans and Loan Modifications

If you haven’t reached the auction stage yet, loan modification and repayment plan programs are your best tools.

- A loan modification restructures your mortgage loan to lower your monthly payment, extend the term, or reduce the interest rate.

- A repayment plan helps you catch up on missed payments by adding a portion of the arrears to your future monthly payments.

Lenders may require income verification, a hardship letter, or access to your credit report before approving changes.

To qualify, you must apply before the foreclosure sale occurs.

Many mortgage lenders will cooperate (especially if they believe you have the ability to recover).

Alternative Solutions for Former Homeowners

Not every homeowner can or should try to get their original house back.

If you’re ready to move on, here are a few smart options to consider:

- Short sale: Sell the home for less than the debt owed, with the lender’s approval.

- Deed in lieu of foreclosure: Transfer ownership to the lender to satisfy the debt

- Reverse mortgage (if applicable): For seniors over 62 with equity in the home

- Explore rent-to-own or owner-financed properties with flexible credit requirements

These paths may reduce the damage to your credit report, avoid lawsuits over deficiency judgments, and create new possibilities for homeownership in the future.

Moving Forward After Foreclosure in Dallas Fort Worth

Foreclosure is hard. But it’s not permanent.

Whether you’re fighting to save my house, exploring how to buy it back, or starting over in a new neighborhood, you still have choices.

If you don’t know where to start, talk to a foreclosure attorney or housing counselor. Many offer a free consultation and the earlier you reach out, the more options you’ll have.

And if you’re considering selling or restarting in a new residential property, working with companies that help people sell their house fast or assist potential buyers with financing could be a smart next step.

Your story doesn’t end with a foreclosure trustee sale. It continues—with knowledge, strategy, and the will to move forward.

**Disclaimer: The information on this page is provided for general educational and informational purposes only and is not intended as legal advice, financial counsel, or a substitute for consultation with a qualified professional. Foreclosure laws, credit score recovery, and deed of trust implications vary by situation and jurisdiction. If you are in the Dallas area and facing foreclosure or considering filing bankruptcy, we strongly recommend speaking with a licensed attorney or foreclosure specialist. Any references to regaining your home fast, the foreclosure process, or repayment options are based on general scenarios and should not be interpreted as personalized legal recommendations.

About The Authors: With 2,800 real estate transactions completed, Hilary and Patrick Schultz lead Bright Bid Homes, a family-first, Texas-based real estate company committed to supporting homeowners facing difficult circumstances like foreclosure. Hilary is a licensed Texas Realtor and holds a Top Agent designation on Zillow for service and performance. In addition to her professional credentials, Hilary is actively involved in her local school community as a Texas PTA executive board member. For more on Hilary’s background, you can verify her license, visit her Zillow real estate profile, or read our story. To see how Bright Bid Homes supports others in similar situations, explore client reviews.